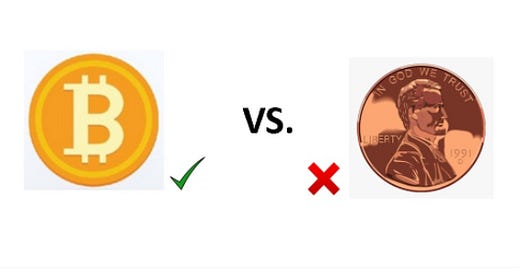

Letter #9: Bitcoin vs. Copper - One Of These Things Is Not Like The Other

Dear Readers,

Bitcoin is a hard topic to ignore these days. Whether you’re at Christmas dinner, scrolling on Twitter, or watching the news, not much time will pass before you’re sucked into a discussion about the latest developments for Bitcoin, the Lightning Network, or any of the other technologies out there.

People demand to know more about Bitcoin. Since Bitcoin is relatively new, there is a shortage of true experts on the topic to satiate the public’s desire to learn. It’s common for “experts” in the financial world to have to field questions about Bitcoin whenever they participate in an interview for news media, a talk show, or a podcast. A handful of these finance experts have spent some time trying to understand Bitcoin and what it offers. However, the vast majority of them know nothing about Bitcoin, but try to seem like they have all the answers anyways. After all, who wants to look uninformed on national television?

Jeff Currie, the Head of Commodities Research at the investment bank Goldman Sachs, recently found himself in the latter camp. During an interview on CNBC this week, Currie doubted the correlation of Bitcoin with store of value assets like gold, instead comparing it to “risk-on” assets like copper and oil. While Currie can be forgiven for not being a Bitcoin expert, his willingness to spout off in an interview on a topic that he doesn’t understand serves as an important lesson to us all: You can look like a fool by pretending to have all the answers.