Dear Readers,

Inflation is the #1 driver of financial inequality around the world. But governments and the economists they sponsor certainly won’t tell you that. Why would they? They profit too much from the inflation they cause.

But inflation does its damage:

Inflation causes purchasing power to decrease, because the cost of goods and services tends to increase far faster for most people than their wages do.

Inflation causes people to save less because they’re aware, even if only subconsciously, that the fiat currencies sitting in their wallets and bank accounts buy less the more that time passes.

Inflation incentivizes people to get into debt, even bad debts, because it tends to become cheaper to manage as inflation takes its toll.

Most people aren’t oblivious to the evils of inflation. They see them every day. So governments have to kick their fear mongering into overdrive in order to convince people that other systems are worse than their own.

The Lie: A Deflationary System Like Bitcoin Isn’t Sustainable Because People Won’t Spend Their Bitcoin

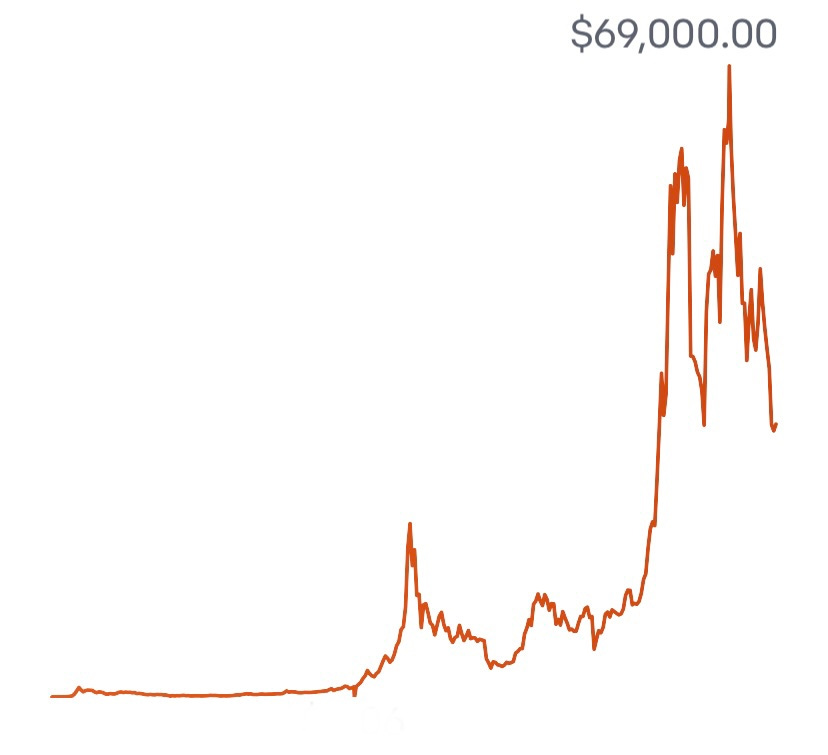

“Hodling” has became a key concept within the Bitcoin community. In a nutshell, it’s driven by an understanding by veterans in the space that short-term fluctuations in Bitcoin’s exchange rates with other currencies have limited impact on the long-term trajectory of the growth in Bitcoin’s value. Looking at Bitcoin price charts, it’s not hard to see why that long-term growth is so tantalizing:

Even though Bitcoin is more than 50% off its all-time highs, Bitcoin’s value per coin has increased from mere pennies to tens of thousands of dollars in the course of just over a decade. And only a fraction of global wealth is currently denominated in Bitcoin, meaning it still has an exponential amount of growth ahead of it if bulls like me turn out to be right.

What this all means is that a lot of people aren’t actually spending their Bitcoin right now. They’re hodling it, day after day, year after year. Since one of money’s primary roles is to be a medium of exchange, critics have claimed that Bitcoin can’t possibly be money if most people don’t spend it.

Critics also argue that Bitcoin will somehow be an innately unfair system, because people who don’t have Bitcoin supposedly will be unable to get some to use as money because hodlers won’t be spending their Bitcoin.

I believe that both criticisms can rather easily be debunked:

Bitcoin Are Being Spent Everyday

Case in point: remittances. Global remittances are big business. Every year, people send hundreds of billions of dollars across borders to friends and family who are in desperate need of those funds. Most remittances are currently denominated in fiat, and those transactions extract massive fees.

Enter Bitcoin. The Bitcoin blockchain is global and is open to any individual or business that wants to send money across borders. While it’s true that only a small fraction of global annual remittances are sent in Bitcoin, it’s an absolute certainty that the majority of Bitcoin remittances are being spent rather than hodled. After all, most people value things like food, shelter, and clothing more than they value any type of money.

Bitcoin Will Be Transferred To Those Who Produce True Value

The idea that people value some things more than they value money is exactly how we debunk the criticism that Bitcoin won’t flow freely out of hodlers’ wallets at a certain point. After all, even the best money (i.e., Bitcoin) is really only good if you can buy the things you need with it.

People are incentivized to trade their time for money because it can buy them things. As we discussed before, inflatable currencies like fiat incentivize people to buy as much as possible now before their money loses its purchasing power. But people using hard money like Bitcoin still have to buy the necessities of life, and will also be incentivized to buy discretionary goods and services that they value more in the moment than their Bitcoin.

In other words, people who don’t have Bitcoin or who want to have more Bitcoin than they possess at any given time can acquire it by selling things that hodlers want or need to spend their money on. People will always spend money. Good money just makes them spend it on worthwhile purchases.

Next time you hear someone trying to scare you away from Bitcoin with half-truths and outright lies, ask yourself if they’d need to do it if the fiat system they’re trying to protect were halfway decent to begin with.

Read the next article in this series:

Scams.

Rugpulls.

Shady companies that will take away your hard-earned money the first chance they get.

That’s what most content creators in the Bitcoin and Crypto spaces offer their communities in exchange for the *free* content they promote in newsletters, on talk shows, on social media, and anywhere else they can peddle their wares.

YOU DESERVE BETTER.

You deserve quality Bitcoin education that isn’t driven by a need to sell you something that will leave you worse off. You deserve thoughtful analyses of Bitcoin basics and current events that leave out the biases that permeate affiliate-driven content platforms. You deserve a community that puts you first, no matter what.

We’ve built the HiFi Bitcoin community together as a place where quality Bitcoin education comes without any hidden agenda. A place where you come first, always.

If you believe that Bitcoin education should be available to everyone without bias and without ulterior motives, I ask you to please consider supporting me and the work I’m doing for the Bitcoin community through a premium membership. Every contribution increases my ability to cut through the noise and find the truth about Bitcoin with you.

A Special Bonus For Premium Members

In my new book, The Ultimate Pocket Bitcoin Glossary, I walk you through 30 of the most important terms you need to understand in order to get ahead in your Bitcoin journey. My hope is that it can be used to educate yourself about Bitcoin and as a quick reference when you’re trying to help others understand why you’ve chosen to purse a passion for Bitcoin.

Ready to read it yourself?

Premium subscribers of The HiFi Bitcoin Letters receive access to The Ultimate Pocket Bitcoin Glossary at no extra charge:

Free subscribers and non-subscribers will be able to purchase The Ultimate Pocket Bitcoin Glossary, without the commitment of subscribership, in the HiFi Bitcoin Shop, once it is released as a PDF:

Wish You Could Easily Take The Podcast With You?

Can’t Get Enough Bitcoin In Your Life? Follow Me On Social Media:

🙋🏽♂️Did You Enjoy This Edition Of The HiFi Bitcoin Letters?

This 3-question survey is your chance to tell me how I can improve the newsletter for you.

This is not financial or business advice. This newsletter and related content are for informational purposes only. Cryptocurrencies and digital assets can be risky. Always do your own research before making any sort of investment.

Share this post