Dear Readers,

It has been said at various points over the past year that institutional interest and investment in Bitcoin has been one of the primary drivers of the ongoing bull market. The law of supply and demand certainly supports that thesis. Bitcoin’s supply increases at a steady rate and the maximum supply of 21 million coins is known. While not all cryptocurrencies have a hard supply cap like Bitcoin, the open nature of blockchain means that investors can typically get an understanding of the high-level crypto supply on the market. As a result, cryptocurrency prices are overwhelmingly driven by demand rather than by supply.

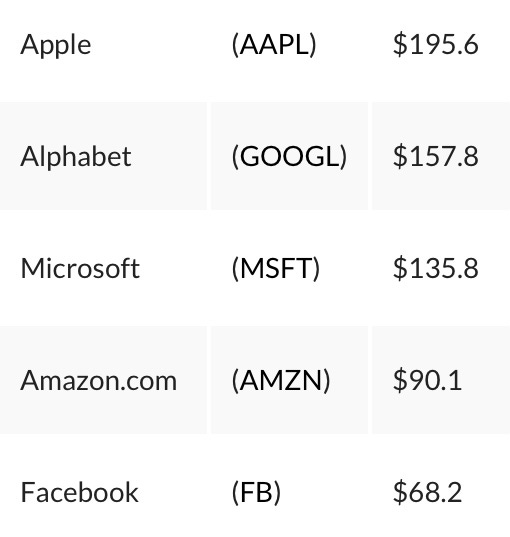

Institutions can be a source of massive demand given the immense amount of cash that many of them have sitting in their treasuries. For example, the five largest companies in just the United States collectively have nearly $650 billion U.S. dollars’ worth of cash and equivalents sitting on their balance sheets:

Retail investment has certainly contributed to the growth of cryptocurrency over the past decade. But that contribution in monetary terms could easily be dwarfed if companies around the globe began to put even small percentages (e.g., 5 - 10%) of the cash on their balance sheets into cryptocurrency.

It is for this very reason that many investors within the space have become extremely bullish on its long-term growth prospects. They believe that cryptocurrency usage is about to reach critical mass, leading a large number of companies, big and small, to allocate resources and capital to the industry, driving prices of cryptocurrencies and crypto assets to the moon. As we’ll see below, it would be hard to argue that they’re wrong.