Dear Readers,

If you’ve been in the Bitcoin space long enough, chances are you’ve heard people throw around the term “store of value” quite frequently. It’s a term I use myself pretty often. But what is value? And who decides what something is worth?

What Good Is A Currency’s “Backing”?

In the context of Bitcoin and other currencies, it’s common to hear people talk about a currency’s “backing”. In simple terms, backing refers to something else that the currency is indelibly linked to and from which it derives its value. Let’s look at an example:

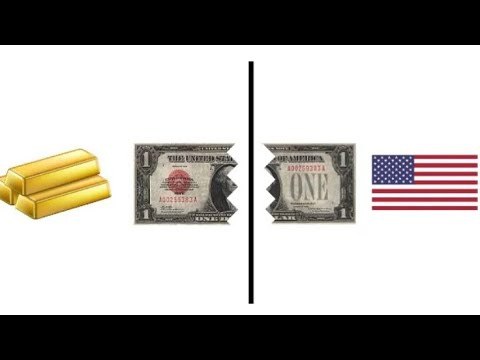

Throughout much of the several centuries leading up to the late 1900s, fiat currencies were often backed by precious metals, usually gold or silver. People had assigned value to gold and silver for ages because they could be used in industrial applications and as jewelry. The fact that they were also relatively difficult to find, mine, and refine certainly didn’t hurt either. Long story short, since the precious metals backing fiat were recognized as valuable by most people on the planet, people decided that fiat currencies backed by the precious metals had value too.

Fiat currencies lost their gold and silver backing throughout the 1900s, culminating with the detachment of the U.S. dollar, the global reserve currency, from its gold backing in 1971. These days, fiat currencies are backed by the credit of the governments that create them. In other words, people assign value to fiat currencies in modern times because governments can force their citizens to use them and because they can tax their citizens’ real property and income, then use those taxes to pay off debts denominated in their fiat currency.