Dear Readers,

Over the past several decades, governments and institutions have increasingly taken control of money to the point that most people are unable to attain any degree of financial self-sovereignty. Many purchases are made using bank accounts and credit cards and the supply of all fiat currencies is tightly controlled by government leaders, who print new money and wreak inflationary havoc at will. Anyone who wants to take control of their own money is out of luck…

Or at least they were until the advent of Bitcoin. Bitcoin has value in and of itself because it’s not a government or bank debt. It’s just money. On top of that, Bitcoin doesn’t rely on any government or institution to run it. In fact, Bitcoin doesn’t care even if they don’t want it to run at all. Bitcoin is freedom money, open to everyone, all the time.

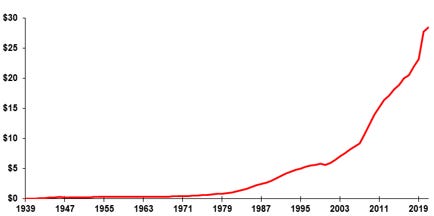

Fiat on the other hand is quite literally a liability of the government that issues it. The more debt that governments issue in the form of fiat currencies, the less the fiat that you already have is worth. And history has shown that governments will issue as much debt as they possibly can. The United States provides an apt example, having issued tens of trillions of dollars of new debt in just the past two decades:

It should come as no surprise then that Bitcoin usage is seeing explosive growth while the entire fiat system begins to crack under the weight of excess debt, rampant money printing, and runaway inflation. Bitcoin flourishes by providing its users with an open system in which each contribution is protected over the course of time by a hard supply cap and a decentralized, worldwide network of miners and nodes. Meanwhile, fiat currencies are on the decline because their victims (i.e., all of us) finally have an escape hatch from the tight-fisted authoritarian deception of politicians the world over.

Take Hold Of Unbannable Money

It seems that governments are beginning to see the writing on the wall and many of them have no intent of going quietly into the night. Some will follow the path of China, which has attempted, wholly unsuccessfully I might add, to eradicate Bitcoin usage by banning everything short of citizens holding onto the Bitcoin they already own. Others may instead try to emulate the United States, which has stopped short of banning Bitcoin outright, but seems to be on a path to regulating it as much as possible.

Bitcoin is unique though, in that it is entirely impossible to control. Governments can try to force corporate Bitcoin miners to block certain transactions, but can do nothing to ensure that small miners who slip under their radar won’t win a block and send those same transactions through. They can try and subvert the Bitcoin network through biased commentary about Bitcoin’s energy usage, but they can’t stop people from plugging their computers into the network using whatever energy source they want. They can confiscate Bitcoin held by crypto-banks and custodians, but they can’t confiscate self-custodied Bitcoin that the holder refuses to give up at all costs.

That last point is particularly important. I’m a firm believer that Bitcoin is safest when it’s custodied by its holder. No matter how convenient or rewarding crypto-banks may make their offerings seem, if you don’t control the keys to your Bitcoin, then your ownership of it continues for only as long as the crypto-bank, or the government regulating it, allows it. After all, if the government comes knocking and tells the people running the crypto-bank to give up your Bitcoin, do you think they’re going to protect your money over their business? They’ll give you and your Bitcoin up in a flash.

Self-custody may seem scary to some, but the learning curve is well worth it so that you can take complete control of your money. No force on earth can take your Bitcoin away from you if your private key is protected and known only to you.

I’d like to help those of you who are curious to learn more about the intricacies of self-custody. In the coming weeks, we’ll talk about the differences between single-sig and multi-sig configurations and do a deep dive into the strengths and weaknesses of the growing industry behind collaborative custody multi-sig wallets.

Read the next article in this series:

Scams.

Rugpulls.

Shady companies that will take away your hard-earned money the first chance they get.

That’s what most content creators in the Bitcoin and Crypto spaces offer their communities in exchange for the *free* content they promote in newsletters, on talk shows, on social media, and anywhere else they can peddle their wares.

YOU DESERVE BETTER.

You deserve quality Bitcoin education that isn’t driven by a need to sell you something that will leave you worse off. You deserve thoughtful analyses of Bitcoin basics and current events that leave out the biases that permeate affiliate-driven content platforms. You deserve a community that puts you first, no matter what.

We’ve built the HiFi Bitcoin community together as a place where quality Bitcoin education comes without any hidden agenda. A place where you come first, always.

If you believe that Bitcoin education should be available to everyone without bias and without ulterior motives, I ask you to please consider supporting me and the work I’m doing for the Bitcoin community through a premium membership. Every contribution increases my ability to cut through the noise and find the truth about Bitcoin with you.

A Special Bonus For Premium Members

In my new book, The Ultimate Pocket Bitcoin Glossary, I walk you through 30 of the most important terms you need to understand in order to get ahead in your Bitcoin journey. My hope is that it can be used to educate yourself about Bitcoin and as a quick reference when you’re trying to help others understand why you’ve chosen to purse a passion for Bitcoin.

Ready to read it yourself?

Premium subscribers of The HiFi Bitcoin Letters receive access to The Ultimate Pocket Bitcoin Glossary at no extra charge:

Free subscribers and non-subscribers can purchase The Ultimate Pocket Bitcoin Glossary, without the commitment of subscribership, in the HiFi Bitcoin Shop, as a PDF:

Wish You Could Easily Take The Podcast With You?

Can’t Get Enough Bitcoin In Your Life? Follow Me On Social Media:

🙋🏽♂️Did You Enjoy This Edition Of The HiFi Bitcoin Letters?

This 3-question survey is your chance to tell me how I can improve the newsletter for you.

This is not financial or business advice. This newsletter and related content are for informational purposes only. Cryptocurrencies and digital assets can be risky. Always do your own research before making any sort of investment.

Share this post