Dear Readers,

We know from prior conversations that Bitcoin is incredibly secure. It’s impenetrable. No one can access your Bitcoin without the private key. That level of certainty is a huge positive in the context of self-sovereignty. Since only you control access to your Bitcoin, only you control your financial future. But on the flipside, if you lose your private key, your financial future might be anything but assured.

When it comes to self-custodying one’s Bitcoin, likely the fear that drives the most people away from it is the possibility of losing one’s private key. Decades of trusting our money to banks, governments, and other intermediaries has made most of us balk at the idea of being completely responsible for protecting it ourselves. As a result, many people in the space have reverted to holding their Bitcoin in crypto banks, putting the burden of private key management in their hands and, often unwittingly, opening themselves up to a whole host of counterparty risks.

But self-custody doesn’t have to be scary and there are ways to minimize the risk of losing the ability to access your Bitcoin. Today we’ll talk about one of the most common ways to do it: multi-signature wallets.

Sign Here Please

If most of your Bitcoin transactions happen on a crypto-bank’s or exchange’s platforms, then you may not have much experience with signing your transactions before they’re confirmed. In fact, you may not have any idea what I’m talking about. After all, on the majority of those platforms, all you have to do is choose an amount, paste the receiver’s Bitcoin address, and then hit “send”. You never really see what’s going on in the background.

What you’re missing is one of the most important parts of the entire Bitcoin blockchain’s process: transaction signing. In order for the nodes and miners on the blockchain to accept any transaction as valid, it must be signed using the private key attached to the sender’s address. Otherwise, the participants on the blockchain have no way of knowing whether the sender owns the Bitcoin being sent and has the right to transmit them.

In case it’s not clear, that’s the real reason protecting your private key matters so much. If it gets lost, you have no way of signing your transactions and proving to the rest of the Bitcoin ecosystem that you’re the rightful owner of a certain Bitcoin address.

Single Sig Wallets

Most consumer-level Bitcoin wallets are single-signature, or single sig, meaning that only one signature from one private key is required to sign a Bitcoin transaction and have the network accept it as valid. This setup is relatively simple and that’s probably why most people use it. You only have to keep track of one private key, whether your wallet is paper-, software-, or hardware-based.

As usual though, that simplicity is a double-edged sword. True, you only have to worry about protecting one private key, but if it gets stolen, destroyed, or lost, you’re out of luck. Your Bitcoin are gone and you have no hope of recovering them. Again, that’s the fear that keeps so many people from self-custodying their Bitcoin. But it doesn’t have to be that way.

MultiSig Wallets

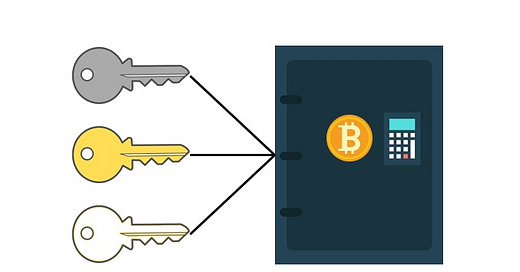

As you might imagine based on the name, a multi-signature, or multisig, wallet is one that requires several private keys in order to validly sign a transaction. But wait, is protecting multiple private keys simpler or safer than only having to protect one? It should be as long as your multisig is set up to only require that a quorum, or majority, of private keys be used to sign a transaction rather than every key. In other words, you can still sign transactions with a multisig even if you lose one of your private keys. You just have to make sure you don’t lose a majority of them.

The most common multisig wallets that you’ll come across are 2-of-3 or 3-of-5 configurations, where the first number represents how many private keys are required to sign a valid transaction and the second number represents the total number of private keys available for signing. Having the ability to sign a transaction without needing all of your private keys eliminates a single point of failure from your self-custody setup, which makes the whole process a lot less risky.

Multisig wallets also allow you to entrust one or more of your keys to other entities, which has a few different applications that are becoming more common:

Assisted multisig setups, in which a third-party specialist like Casa or Unchained Capital manages a key for you.

Escrow services, in which a buyer, seller, and escrow agent each control a key as part of a transaction in which Bitcoin is used in exchange for a good or service.

Trust management, in which keys are distributed among family members or other trusted individuals to manage shared assets.

Remember though, while such applications remove you as the single point of failure, you re-introduce a certain amount of counterparty risk anytime someone else controls one or more of your private keys.

Whether you personally hold all or just some of the private keys controlling your multisig wallet, you’re more likely to sleep soundly knowing that the chances of completely being locked out of your Bitcoin wealth, whether by loss, theft, damage, or censorship, are much lower than they would have been otherwise.

Read the next article in this series:

Scams.

Rugpulls.

Shady companies that will take away your hard-earned money the first chance they get.

That’s what most content creators in the Bitcoin and Crypto spaces offer their communities in exchange for the *free* content they promote in newsletters, on talk shows, on social media, and anywhere else they can peddle their wares.

YOU DESERVE BETTER.

You deserve quality Bitcoin education that isn’t driven by a need to sell you something that will leave you worse off. You deserve thoughtful analyses of Bitcoin basics and current events that leave out the biases that permeate affiliate-driven content platforms. You deserve a community that puts you first, no matter what.

We’ve built the HiFi Bitcoin community together as a place where quality Bitcoin education comes without any hidden agenda. A place where you come first, always.

If you believe that Bitcoin education should be available to everyone without bias and without ulterior motives, I ask you to please consider supporting me and the work I’m doing for the Bitcoin community through a premium membership. Every contribution increases my ability to cut through the noise and find the truth about Bitcoin with you.

A Special Bonus For Premium Members

In my new book, The Ultimate Pocket Bitcoin Glossary, I walk you through 30 of the most important terms you need to understand in order to get ahead in your Bitcoin journey. My hope is that it can be used to educate yourself about Bitcoin and as a quick reference when you’re trying to help others understand why you’ve chosen to purse a passion for Bitcoin.

Ready to read it yourself?

Premium subscribers of The HiFi Bitcoin Letters receive access to The Ultimate Pocket Bitcoin Glossary at no extra charge:

Free subscribers and non-subscribers can purchase The Ultimate Pocket Bitcoin Glossary, without the commitment of subscribership, in the HiFi Bitcoin Shop, as a PDF:

Wish You Could Easily Take The Podcast With You?

Can’t Get Enough Bitcoin In Your Life? Follow Me On Social Media:

🙋🏽♂️Did You Enjoy This Edition Of The HiFi Bitcoin Letters?

This 3-question survey is your chance to tell me how I can improve the newsletter for you.

This is not financial or business advice. This newsletter and related content are for informational purposes only. Cryptocurrencies and digital assets can be risky. Always do your own research before making any sort of investment.

Share this post