Dear Readers,

If there’s one thing we can say about the Bitcoin space, it’s that it certainly keeps us on our toes. And that has definitely been the case this week as Bitcoin’s fiat-based exchange rates have plummeted. Of course, no one can accurately guess where the “bottom” will be, but it’s important to keep the proper perspective:

The thesis for using Bitcoin hasn’t changed. Bitcoin is still global decentralized money that is resistant to confiscation, censorship, and inflation. That was true last week and last year, and it will still be true decades from now. Bitcoin’s volatility keeps us on our toes, but its use cases keep us in the game.

So What’s Happening To Bitcoin?

It’s of course impossible to attribute Bitcoin’s volatility to just one thing, but there was one event that stood above the rest early this week:

Celsius Network, perhaps the largest crypto bank in the space, completely cut off its users’ ability to access the assets they had stored on the platform, including withdrawals. Celsius has billions of dollars worth of assets on the platform. Its move to shut its users out impacted hundreds of thousands of users and tens of thousands of Bitcoin.

Unfortunately, Celsius’ actions also kickstarted a mad dash for the exits. Billions of dollars’ worth of Bitcoin have changed hands over the past few days, and there have been far more sellers than buyers. On top of that, Celsius’ top competitors, crypto banks like Nexo and BlockFi, have presumably come under pressure, as they have publicly clarified their own risk management to keep users from abandoning their platforms outright.

It’s been a tough week for many in the Bitcoin space, but perhaps not for everyone…

But First, A Moment Of Silence

My heart goes out to Celsius users whose assets are currently locked up. I have no doubt that they’re hurting, whether they have hundreds or tens of thousands of dollars’ worth of Bitcoin on the platform. It’s certainly not something I would wish on anyone.

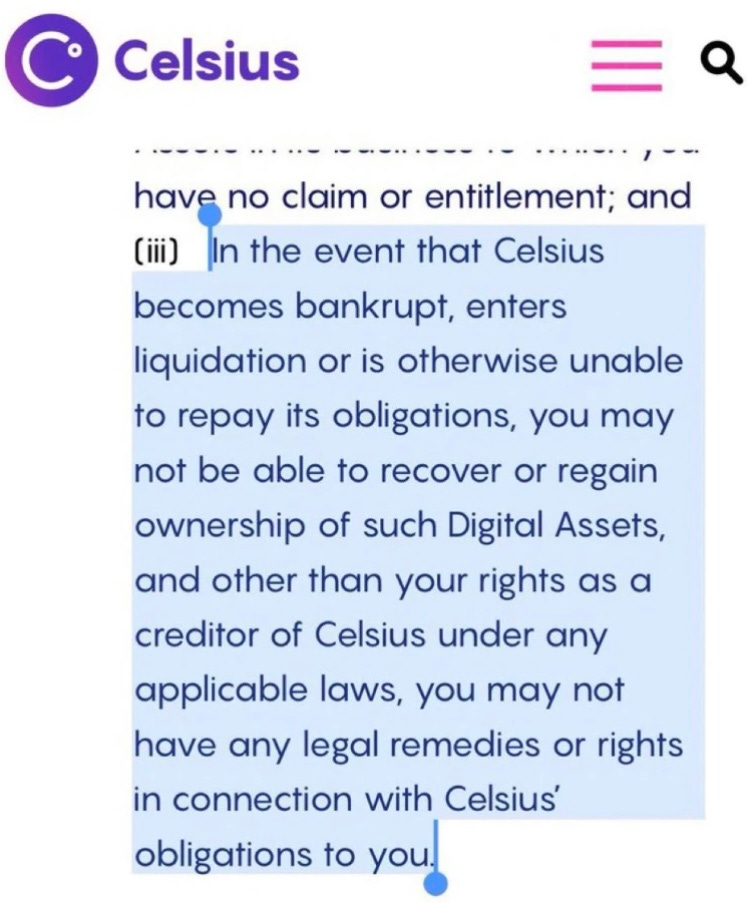

But perhaps some good can come out of the situation, at least for those users who decide to take control of their Bitcoin and become financially self-sovereign by doing so. After all, our Bitcoin will always be at risk of being seized or locked up when we leave them in someone else’s hands. In fact, the move to lock up customer assets was always in Celsius Network’s playbook:

I shared the above screenshot just a few weeks ago, but I won’t pretend that I thought Celsius Network would make this move so soon thereafter. Regardless, these types of developments beg the question: if you let someone else custody your Bitcoin, are you sure they’re really yours?

Keep Your Keys, Keep Your Coins

Your Bitcoin are yours and there’s one sure fire way to ensure that is always the truth: self-custody. The only way to control Bitcoin is to control the associated private key. If you alone hold the private key, your Bitcoin can’t go anywhere without your approval. But if someone else holds the private key, you’re forever at their mercy.

Critics want you to believe that self-custody isn’t safe. But nothing can keep your Bitcoin safer than self-custody if you do it right.

I admit that I didn’t jump right into self-custodying my own Bitcoin when I originally purchased some several years ago. My Bitcoin journey has been one of learning, bit by bit. And how to self-custody my Bitcoin is perhaps one of the most important lessons that I’ve learned.

The choice is ultimately yours, but I invite each of you to begin your own journey towards self-custody. Take time now to learn how it works and what the best setup is for you and your situation.

And if you’re not sure where to start, check out the mini-series I wrote a few months ago all about self-custody:

Read the next article in this series:

Like What You See, But Not A Subscriber Yet?

Consider subscribing for two weekly emails about Bitcoin, subscriber giveaways, real-time community discussions and more!

A Special Bonus For Premium Members

Don’t forget that premium subscribers to HiFi Bitcoin get exclusive access to premium educational resources at no extra charge.

Wish You Could Easily Take The Podcast With You?

Can’t Get Enough Bitcoin In Your Life? Follow Me On Social Media:

🙋🏽♂️Did You Enjoy This Edition Of The HiFi Bitcoin Letters?

This 3-question survey is your chance to tell me how I can improve the newsletter for you.

This is not financial or business advice. This newsletter and related content are for informational purposes only. Cryptocurrencies and digital assets can be risky. Always do your own research before making any sort of investment.

Share this post