Dear Readers,

For decades, the finances of everyday people have been tied up in the hands of governments and corporations, and have been manipulated or outright stolen by those same people. We as a society have arrived at the point where it’s next to impossible to believe that corporate CEOs and government bureaucrats have our best interests at heart. Our finances, economies, and money need to change.

I’m a huge proponent of financial self-sovereignty. Since we can’t trust our finances to anyone else, we need the tools to be able to trust ourselves. I believe strongly that Bitcoin is the major step in the right direction that the world so desperately needs. For the first time in history, we have money that can be completely resistant to censorship, confiscation, and inflation. But whether it is or isn’t depends entirely on how we choose to manage, or not manage as it were, our Bitcoin.

Wherefore Art Thou Bitcoin?

Case in point: tens of billions of dollars’ worth of Bitcoin are sitting in the treasuries and vaults of exchanges, crypto-banks, and custodians rather than being under the control of Bitcoin users themselves. That’s a lot of Bitcoin.

Granted, a lot of those people are afraid of holding onto their own Bitcoin. They’ve heard too many stories about the guy who accidentally threw away the private key protecting his ~8,000 Bitcoin. But risk of loss aside, controlling the keys to one’s Bitcoin is an essential component of achieving true financial sovereignty as we’ll see below.

By the way, if you’re afraid of self-custodying your Bitcoin or unsure where to start, I’ve got you covered. Check out the mini-series I wrote recently all about self-custody:

My Bitcoin Are NOT Your Bitcoin

People choose to leave their Bitcoin with centralized custodians because those businesses have given them the impression that their assets are well-protected and will always be accessible. History has repeatedly shown that to not be the case, most recently in what was probably meant to be an obscure regulatory filing by Coinbase, one of the world’s largest cryptocurrency exchanges. But news around the filing has blown up courtesy of a particularly nefarious risk to Coinbase users that was disclosed:

It would be natural for you to think that the money you transfer into Coinbase and the assets you purchase with that money would be yours and yours alone. After all, your employer recognizes it as your money when your paycheck gets sent out and the government recognizes it as yours when you get taxed. But somehow, through the contortions of bankruptcy proceedings, assets that are supposed to belong to you could be lumped in with any Coinbase’s actual creditors are entitled to if it goes under. You could lose everything, through absolutely no fault of your own.

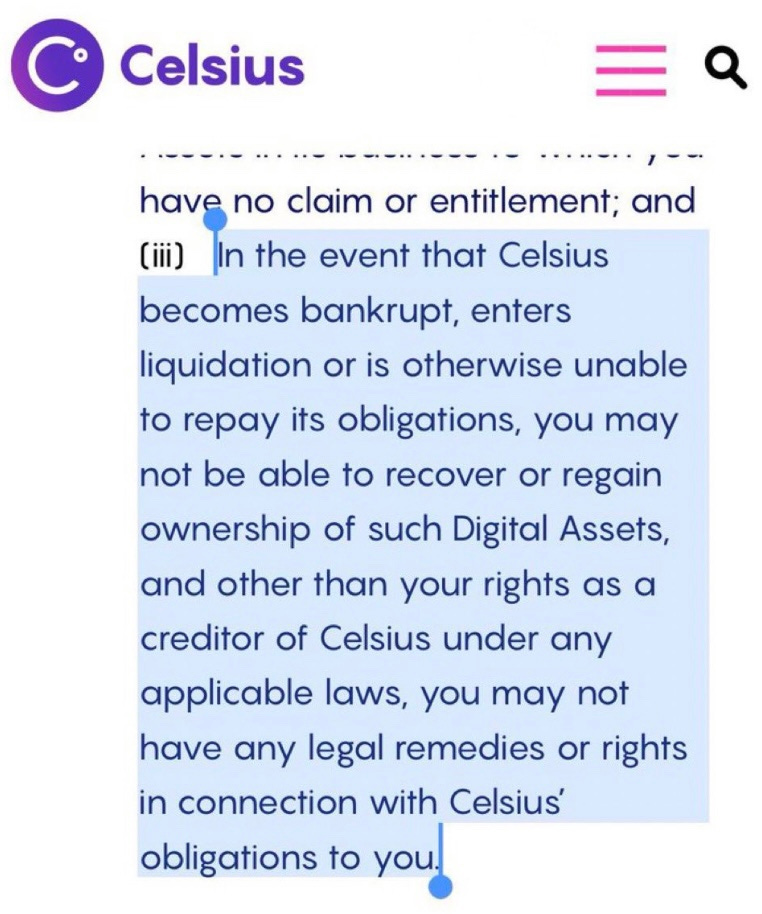

Don’t think this existential (for your financial self-sovereignty) risk is exclusive to Coinbase. It also exists with Celsius Network, one of the world’s largest crypto-banks, and likely with many other custodians, whether they admit it or not:

Not Your Keys, Not Your Coins

It’s very simple. If you don’t control the keys to your Bitcoin, you don’t actually have any Bitcoin. You have a promise from the person or company holding your Bitcoin that they’ll be delivered to you when you ask, and you have a hope that the promise won’t be broken. If you’re still inclined to entrust your Bitcoin to a custodian, just ask users of Mt. Gox, Bitfinex, and Africrypt how that worked out for them.

Don’t subject yourself, your financial self-sovereignty, or your Bitcoin to that risk. Many of the businesses in the space may be extremely well-intentioned. They may have top-notch security policies. They may have robust insurance policies. They may have all sorts of regulators peeking over their shoulders. But when it comes down to it, if they lose your Bitcoin private key or just refuse to give it back, there’s nothing you can do about it. You put the keys to your Bitcoin kingdom in someone else’s hands.

Consider doing something now, before it’s forever too late.

Read the next article in this series:

Like what you see, but not a subscriber yet?

Consider subscribing for two weekly emails about Bitcoin, subscriber giveaways, real-time community discussions and more!

A Special Bonus For Premium Members

Don’t forget that premium subscribers to HiFi Bitcoin get exclusive access to premium educational resources at no extra charge.

Wish You Could Easily Take The Podcast With You?

Can’t Get Enough Bitcoin In Your Life? Follow Me On Social Media:

🙋🏽♂️Did You Enjoy This Edition Of The HiFi Bitcoin Letters?

This 3-question survey is your chance to tell me how I can improve the newsletter for you.

This is not financial or business advice. This newsletter and related content are for informational purposes only. Cryptocurrencies and digital assets can be risky. Always do your own research before making any sort of investment.

Share this post